Part of the problem derives from broader economic trends. Between 2010 and 2013, average out-of-pocket expenses for healthcare increased by $1,800 annually while the median annual income dropped by $2,300. However, in addition to overall climbing costs, the study identified two factors in particular that are contributing to medical debt, both of which point to a troubling lack of transparency in the industry.

Medical Debt

Firstly, medical billing errors are at an epidemic level. Researchers analyzed hundreds of Medicare investigation records from the Office of the Inspector General originating from 34 hospitals. About half of Medicare claims reviewed contained errors, all of which were in favor of the provider and at the expense of the government and the patient. In all cases, hospitals were forced to reimburse the government. If this data can be extrapolated onto private insurance claims, which are not subject to the same scrutiny as Medicare, it is likely that many Americans are paying more than they should for services.

Another area of concern related to medical debt to researchers is the lack of hospital pricing standards. For instance, some hospitals in California charge up to 50 times more than hospitals in Texas for the same services. The widest disparity they found was a $200,000 difference in cost for the same procedure. Pricing can even dramatically differ between hospitals in the same state; a hospital in Suffern, New York, charges 15 times more for an MRI than a hospital in the Bronx.

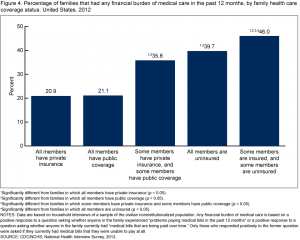

The CDC’s 2012 National Health Interview Survey claims that one-in-four American families reported financial hardships due to medical expenses. Unsurprisingly, families with children, families with low-income and families without health insurance experienced the greatest burdens. Fortunately, the 2014 Commonwealth Fund Biennial Health Insurance Survey suggests that the number of uninsured Americans dropped from 37 million in 2010 to 29 million by the end of 2014 which should reduce the amount of medical debt. Also, the number of Americans who forgo needed medical treatment due to cost declined from 80 million people to 66 million people over the same time period. The survey attributes these changes largely to the Affordable Care Act. While these numbers mark progress, they do little to address the astronomical costs of healthcare in the U.S.

Medical Debt

While there is little individuals can do to address the systematic issues affecting healthcare, consumers can be proactive in controlling their own medical costs. Patients should always carefully review their medical bills and immediately contact the provider and their insurance company if they have questions about charges to avoid medical debt. If possible, patients should compare prices for procedures before choosing a provider. Patients should also be firm when negotiating payment plans. Many hospitals have charity care programs for low income individuals, but patients have to reach out for help to learn about these options.